For as long as I can remember, I knew my parents would pay for my room and board when I went to college and I would be responsible for paying for my tuition and books.

Both sets of my grandparents did this for my parents, and now Bart and I plan to do the same thing for our children.

We like this strategy for several reasons (reasons which we’ve mostly stolen from my parents, as we do):

First, it incentives our children to perform well in school or extra-curricular activities so they can get a scholarship. I knew that if I got a scholarship, all that savings would go directly into my pocket, so I really wanted to get good grades and do well on the ACT (since academics were basically my only shot at a scholarship, considering that my athletic, music, and artistic abilities are non-existent). And paying for your own tuition means you really want to keep that scholarship too, not lose it after one semester of not taking school seriously. During our move, I found the letter my dad wrote me when I left for college and one of his ten pieces of advice was DO NOT LOSE YOUR SCHOLARSHIP (and I believe it was in all caps).

Second, we really want our children to live on-campus. Both Bart and I are strong proponents of living on-campus as freshman (at least at BYU), and we don’t want our kids to miss out on that because they are trying to save a few dollars. The majority of my best memories in college are from my freshman year, and one of Bart’s biggest regrets about his college experience is that he didn’t live in the dorms.

Third, having our children pay for their tuition gives them a strong motivation to graduate in a timely manner. It’s kind of unbelievable to me how long some people take to graduate these days. I can certainly understand if there are health issues, or if you get married young or have a child or are working full-time while trying to graduate, but even at selective top-tier universities, only 36 percent of full-time students graduate in four years. At public universities in general, the rates drop to 19 percent graduating in four years or less and education policy now uses six years as the standard length to get a bachelor’s degree (imagine me scraping my jaw off the ground here). Bart and I are not interested in funding years and years of higher education while our kids switch majors, don’t take full course-loads and generally waste a bunch of time and money. I only spent three years on campus (then finished my last three classes online when we moved to Texas), which meant that I was able to work full-time for a year before doing a master’s degree, and then work for a year after that before having a baby at age 24. (Let this long paragraph be a warning to you to never bring up this subject in our home, or Bart and I will talk to your ear off).

Fourth, we want our kids to see higher education as part of a route to a job and a career. I don’t believe in “education for education’s sake,” at least not when you’re paying tens of thousands of dollars for that education. Bart and I both have liberal arts degrees and a love for learning in general, but I think you’re fooling yourself if you think the only reason to go to college is to become well-educated. At least a large part of the equation needs to be what you’re going to do after you graduate and we feel a big responsibility to help our girls have an end goal in mind when they go to school so they can graduate with the ability to provide for themselves with an interesting job and a good career trajectory. Especially if you’ve taken out loans to cover your tuition, you’ll really want a way to pay back those loans once you graduate.

Of course, we’re lucky to even have the ability to consider how and what we want to pay for when our children go to college, and with three kids, we know just paying for room and board will be a hefty chunk of change on its own. For kindergarteners like Ella, experts estimate they’ll need around a quarter of a million dollars to attend a four-year college (yikes!).

Since October is Arizona CollegeSavings month, I’ve been looking through the AZ529 plans where you can save for your child’s college education. You can use it for any accredited institution, whether it’s online, an academic or vocational program, and it’s in your name, rather than your child’s, so they don’t lose financial aid eligibility. Plus, you can use the money for any educational expenses, including room and board.

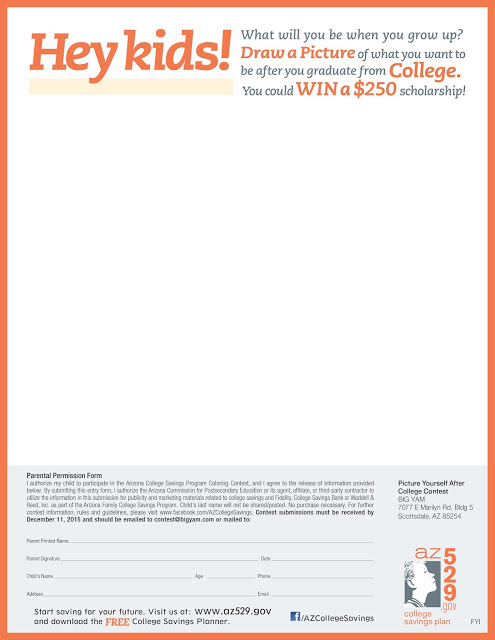

You can start with as little as $15 a month in a AZ529 plan, and this form is super useful for helping you figure out how much you should be saving. You can jumpstart your child’s savings with a $250 scholarship – they can color a picture of what they want to be when they grow up and mail it in by December 11th.

I’d love to hear about how you and your parents handled college finances for you and how you plan to pay (or not pay) for your child’s education. I could talk about it all day long.

My parents paid for my full college educations – and my sister and brothers. All three of us got great grades and graduated in 4 years. We knew our parents were making a sacrifice to pay for it all, so we were very motivated to study and do well. My husband and I plan to pay for our sons full education. We started a 529 plan as soon as he was born. My husband never finished college because it was too hard to pay for it and work full time. He really wishes he had that degree. We want to give our son more than his parents were able to give him.

My dad was out of work for a year and a half when I was in high school. He worked for NASA and aerospace was constantly losing money. He eventually changed industries but he and my mom spent all their savings to keep us afloat. I got into my first choice school but there was no way they could afford it so I ended up at a state school twenty minutes from home. I was devastated at the time but in the end it really worked out. And I met my husband in college.

I paid for college mostly with loans and senatorial scholarships. I probably could have gotten a full ride to the state school I went to, but by the time I applied, all the scholarship money had been awarded. I worked full time and also ran a pet sitting business on the side my last two years. Some nights I got four hours of sleep. The pet sitting paid for my car and books and my job paid for food and clothes and other expenses. In lieu of rent, I did all the housework and laundry (my brother paid rent when he was in college, he was not inclined to clean bathrooms.)

My parents carried me on their car insurance but I paid the premium and for gas and maintenance.

If I was home, I ate dinner with the family, but I bought my own food for lunches and stuff.

Looking back, I'm glad I didn't live on campus. I'm fiercely private and introverted, and so much close living would have made me crazy. At home I had privacy and quiet to study and saved a bundle by not paying room and board.

Plus the school I went to now has a rule that freshman residents can't have cars on campus. Not enough parking. My job was in my field of study and also paid more than on campus jobs, so the car was really essential.

I don't know how anyone affords college now. I got four years and a summer session for 14K at a great school.

I worked full-time (40 hours a week) while taking 16+ credits a semester. It was hard. I knew since I was young that my parents were unable to contribute and made the decision not to go to college until I was 21. I loved at home (for free) and was still on my parents insurance so I was blessed enough that the money I would make went to my education.

Both Derek and I fully paid for our educations. Derek's parent's reason was to teach their kids responsibility even though they could have more than afforded to pay for his education, and mine was for the mere fact that my mom made a whopping $200/wk my senior year of high school. I got certified in Dental Assisting right out of high school so that I could work and pay my bills when I got to Utah, and Derek worked full time and did school, which seemed hard at the time but now that we'll be finishing him MBA with only 20k in student loan debt we feel pretty grateful for the decisions we made given the circumstances.

Oh and it took me eight semesters to get an associates degree. So there's that.

I think my parents paid up to a certain max amount. So it was up to us to decide how to best use that money. If we went to a more expensive private school, then that meant we had less to spend on room/board or fewer years of tuition. I got a full tuition scholarship for all 4 years and a year's worth of room and board cash scholarships so I came out ahead by the end of my 3.5 years and had a great little leftover amount after graduating. We will probably do something similar for our kids. But some of my siblings who went to more expensive schools ended up having to take out loans to pay their way. I do agree with your stance regarding education for education's sake. Especially with the Internet and these awesome things called libraries and books…you can become educated on any subject you want throughout your life while not investing thousands of dollars and extending your college experience to do so.

My parents funded my education through my masters degree, but I also received hefty scholarships along the way. It was made clear that the scholarships (which were well over half the total cost of tuition & housing) counted as my contribution to my education, since it was my work that earned them and my job to keep them. If I had lost a scholarship, I would've been responsible for paying that part of the cost. In addition to gratitude to my parents for this, I was taught that my grades were my "job" and that my "salary" was the scholarship money. I worked on campus during school as well, but this made me aware that the "job" that took priority was the one that kept my scholarship.

I 90% agree with you. I just have to throw out my support for occasionally making the (very difficult) decision to attend school for longer than 4 years and choose a major that doesn't have a clear career plan. Both my husband and I had to go to school longer than expected (6 and 4 1/2 years respectively.) Many majors require every inch of your 4 years to accomplish their requirements, and really, how many 18 year olds know exactly what they want from the beginning? But we were always working hard towards a major (just not the ones we ended up in.) I could have chosen an easier major and graduated in 3 years, (not saying you chose an easy route but many short programs are fluffy,) but I am grateful I chose something rigorous. As my dad frequently reminds me, most people don't end up working in their major so you better use college to learn how to learn. I also chose to major in music (cue all the "would you like fries with that" jokes), which has been a great career path for me. I only work part time and stay home the rest of the time with our nine month old, but I'm able to pay for our rent and do what I love. If you choose a major without an obvious plan towards stability you will have to work hard and be very creative to figure it out, but it can be done. I teach privately, teach at a school, gig around town, and blog at pluckyviolinteacher.com. I initially started school as a mechanical engineering major (I love math almost as much as music) but I don't think I would have been nearly as happy. Life is about more than just the size of your savings account.

Also my husband is graduating with his master's of engineering next month with $6,000 of student loans and I graduated with no debt (thank you academic scholarships) so it's not like we're totally money stupid.

Side note: I lived off campus where it was cheaper, and I am so glad I wasn't living with party crazy freshmen. Bleck.

2nd side note: I've been reading your blog for awhile but never commented. I am pretty passionate about this topic. Sorry to intrude now. 🙂

Well, I live in Quebec, so college is (for now) much cheaper than it is for you guys. We live a 30 minute walk away from three colleges (in Quebec those are free) and one university. Unless our daughter wants to study in another city, she'll probably stay home, and we're putting money aside to pay for tuition (I figure $25 every two weeks is going to make a good dent – she's almost 4yo). She'll probably get a reasonable student loan, too (I'd be very very surprised if she needs more than 10K to pay for the standard 2 years college + 3 years university – and the interest rates are very low and tax-deductible).

Do I sound braggy? I do, don't I? I love my country.

I admit that the free-ness makes it a little easy to get stuck in those issues you mention: switching majors, studying for studying's sake, staying in school too long, not getting a job right away, etc. I'm not actually sure where I fall on that. Considering how cheap it is to get an education here, I don't think it's "wasted" if someone wants to study History or Philosophy or other degrees with low odds of finding a job… but time is also a precious ressource. I don't know!

Oh, I forgot to mention – my parents' policy was to pay for everything before we turned 26. My sister and I lived at home while we studied, but my brother did his "free" college (cégep) in another city, his first 3 years of university at home, and his grad school in another city again. They agreed on a room/board budget. The notion of campus living is almost non-existent here, though. Most people live in apartments off campus.

My husband and I are split on the topic, but we don't have kids yet so we have a bit of time to figure it out. His parents weren't able to provide anything for his college and he was the first in family to go. He researched many scholarships and found one that fortunately provided a full ride. He is grateful for his degree and the sense of ownership he had for working to achieve the scholarship(s) to provide the funds.

My parents' policy was that they would provide the in-state tuition and room/board for four years. However, if we decided to go out of state or to a private school, we knew the difference was our responsibility. My brother, sister and I all went to private or out-of-state schools, so we knew our obligations. I graduated a semester early and was an RA to save on room/board to save some money, but I still graduated with loans.

I hope to be able to provide some money to my kids, but I also want them to pay for part of it themselves as I think it provides a lot of good life lessons in financial management.

My husband and I have A LOT of experience with education – different schools, different degrees, etc. My husband and I both went to BYU and graduated in 4 years with bachelor's degrees in engineering (for him) and history (for me). Then we both got master's degrees – Harvard Graduate school of education (for me) and Chemical engineering from MIT (for him). Then, my husband went on to get a medical degree from Baylor. He is now doing his fellowship at Huntsman Cancer in oncology and I am doing another master's degree in English at BYU. I also teach freshman writing. I think this debate is very interesting and feel very passionate about it. I also think living on campus is a nice idea, but not perfect for everyone. And, with most boys going directly from high school onto missions, living on campus freshman year is not the same experience and often a strange choice. Also, how do missions change this equation? If your child is saving for a mission, would you still make them pay for their own tuition and books? How would they handle that if their savings was all going to pay for a mission? Or would you pay for the mission and still insist they pay for their tuition? What if your child tries their hardest and still doesn't get a scholarship? Should they still be held accountable in the same way that a child who finds good grades much easier? I think there are lots of other factors in this debate.

Anna you bring up a good point regarding LDS culture and missions. I have one boy and a boy on the way, and my husband and I are trying to figure out how to approach the financial aspect of their (probable) future. Neither myself nor my husband had college paid for by parents, but his parents helped with his mission, and my parents helped my brothers pay for their missions. Perhaps helping our boys pay for some parts of college would be the reward for them earning the money for their missions? We aren't sure how to approach it. Any good ideas would be helpful!

So what is your advice if my parents cannot afford to pay for my college room and board and I want to leave college with as little debt as possible? Although I might enjoy living in a dorm, I'm not going to take out a loan to make that happen. Also, if I need to take fewer courses for a couple semesters so that I can work and keep from going too far into debt I'll do that. Although it isn't the ideal, I think it is best for me. I'm planning on starting out at a community college for two years and then transferring to a four-year college to finish my bachelors. Do you have any advice?

Both my parents' and my husband's basically gave us a set amount per year and then we had to cover the rest with scholarships, loans, or money. My husband went to a local school, lived at home, and his whole tuition/fees was covered by what his parents gave him. I went away to a 4 year private school, lived on campus for 3 years (and with my cousin the 4th) and ended up $15k in debt which we thankfully were able to pay off in less than that it took for me to earn my degree. We plan to do something similar with our kids, have already started and contribute monthly to our son's 529 plan. Hoping that will mostly cover the amount we plan to contribute!

My parents did similarly, and we plan to do the same. Your point number 4 though is really what needs to be emphasized in our culture, particularly at BYU. I feel like we tell our girls (in LDS culture) to go to school and get an education, but there is not enough guidance and encouragement for how to turn that education into a career. Julie de Azevedo Hanks wrote a whole article on this and I wish I knew where it was so I could copy the link here. I have a college degree but was not encouraged by family, teachers, advisers, or society to prepare for and begin a long term career. We could definitely use more support in this area.

That seems fair, but make sure your kids know where their options are. They probably shouldn't apply to most private elite schools, because often the tuition is based on what your parents can pay, so if your parents won't pay they aren't real options. This is only a problem if they set their eyes on something like Harvard and then win the lottery to get in. Most of those schools are overpriced and inequitable anyway, so no loss.

First of all, I love your blog because your sponsored posts have ACTUAL CONTENT. Thank you. Second, I agree so much with most of this. My mom always taught us that she left home at 18 not knowing that 1) you could carry a balance on your credit card (i.e. not pay the full amount each month) and 2) that you could graduate college in more than four years–she thought it was just like high school, and when your 4 years were up, you were either done or not! She emphasized to us kids how helpful these notions had been to her. I was fortunate to graduate college in 4 years; the nursing program at BYU was a 4-semester pre-requisites and 5-semester program degree, and I crammed the pre-reqs in because going to school more than 4 years wasn't an option in my book! The advisement center hated me for that. As for paying for it, my parents started savings accounts for each of us kids without exact rules on what those funds would pay for for each kid. Growing up, they also required us to pay 25% of our allowance and other earnings from babysitting/odd jobs to our college funds, and they would match whatever we put in, even if it was more than the required 25%. So I went to college with thousands of dollars that my parents and I had saved together, and they turned it all over to me to manage for rent, food, books, gas, etc for the next four years. I feel like this quickly helped me learn smart money-management techniques, and motivated me to keep my scholarship all 4 years and keep saving by working a lot in the summers. My husband worked every semester and paid for his entire education, graduating with only 2,000 of debt from the semester he student taught and couldn't work. He actually liked it that way, and feels like he really earned his degrees. So, I have no idea what we will do for our children. Also, we both LOVED living in freshman housing and each made lifelong friends there, and would want the same for our kids at BYU. I got a nursing degree that has been such a good fit for being a mostly stay-at-home Mom, with flexible hours and lots of job options. In preparation for that, one of the smartest decisions I've ever made was to use a portion of my college savings to take a CNA class during my senior year of high school. I made pretty good money during summers, found a career I was passionate about, and got great experience that helped me get a job right after graduation, when the job market was poor and a lot of my classmates had to wait several months for a job offer. I think that would be applicable to several teenagers/college kids–working a not-quite-entry level job before and during college.

A quarter of a million- mercy. It's gotten ridiculous. I have no idea what we'll do, I'm not sure I'll even know what everything will be like once we get there! Taylor's parents didn't pay a dime for any of them because they were pretty poor, but our situations were different than the norm- I lived at home the first year (and was married the second!) so I never lived on campus, I had half tuition because my dad worked at the university and I had some scholarships the first year, Taylor's tuition was paid by grants (thank you Engineering!), we just paid for all of our expenses through working. Then grad school was all paid for with grants and a stipend on top of that. I feel we were pretty spoiled, so we don't have the average experience. You are probably bored of everyone's stories. I don't have any suggestions! I hope my kids get and use their education in a practical and realistic way, instead of getting ridiculous debt they can't pay!

I like your approach! I might use it for my own hypothetical children one day. When I went to college, my parents had told me up front that they would pay for everything for 4 years, but if it took me longer than that, I was on my own. Well, I ended up finding that as a fairly slow and thorough reader, I could take 5 classes each semester and feel stressed and probably do poorly in all of them, or take 4 and do very well in all of them… so I ended up taking 4.5 years to graduate. And true to his word, my dad did not pay for my last semester, and I ended up with some loans when I graduated. That last semester was also the loneliest of my life because all my college friends had graduated at 4 years so I had one semester alone there.

So that last semester, I was lonely and paying for it out of pocket and it sure did motivate me to do well academically and make it count.

Also, I studied Hospitality & Tourism Management which is the world's biggest waste of money. YOU DO NOT NEED A DEGREE TO WORK IN HOTELS. And now I'm a financial advisor with an irrelevant degree in hospitality. I think I will STRONGLY encourage my children to take a year or two post-graduation to try working and see what they like, before picking their degree. I just had no idea and if I could go back now and choose all over again, I would.

I loved this so much that I sent it to my husband! We don't have children [yet] but we often talk of this. Both of us paid our way through college – we both went to the University of Georgia and while the rest of our friends were having a good ol' time, we were holding down 2-3 jobs a piece to pay for everything – and that was on top of having what was essential a full ride scholarship!! Living expenses are big chunk of moola that many people don't take in to consideration when thinking about college.

As you said, having to pay for it ourselves was highly motivating – I finished in three years and my husband finished in four with two degrees. However, having to juggle work and school, not to mention the stress that comes with trying to make sure all the bills are being paid while still maintaining good grades to graduate.

Now when the subject comes up, we haven't come up with a good plan for our children – we don't want to pay for their tuition for the reasons you listed but we also don't want them to struggle as much as we did. I really love your suggestion! It's a perfect compromise! Thank you for sharing!

I have to say that I've been thinking about this topic all day long and especially while I was making dinner – which is a good sign that you picked a great topic. I can also see that I'm not alone and I've enjoyed reading the comments.

At first, I didn't think I agreed with you (which is just fine in my book, everyone is entitled to their opinion) but the longer that I thought about it the more I found myself going back and forth on the topic and where I stood.

I personally paid for my education, I'm not sure it was talked about growing up very much though. It was expected that we would get a higher education which put a lot of pressure on me because I wasn't the world's best student. My strong suit was that I was an entrepreneur from a very young age, I started my first business when I was 11. I knew that school wasn't going to be my "path" but it was communicated to us, although I can't remember how, that we were expected to graduate from college. I took a few years off between high school and college, I had gotten very sick before I started my freshman year and so I wasn't able to start school until I was 21. Most of my friends were in their junior/senior years as I was thinking about starting my freshman year. I didn't like this and because I was so much older than my classmates, I didn't really fit in. I had decided that while I was recovering from my illness that I would major in interior or fashion design, which encompassed my natural talents and abilities and fulfilled the requirement of getting a higher education. I took out $50,000 for four years and worked as much as I could while going to school to pay for my living costs. Although my parents expected us to go on with our education they didn't agree with my choice to major in design and didn't want to help me financially. I borrowed the money via a student loan with a low interest and it took me a LONG time to finally pay it all back. A few things that I will say about borrowing the money or paying for it myself… I really wasn't making very much money and when I borrowed the money, I don't remember there being a discussion what my monthly payments would be when it was time to pay the loan back. The payment to my student loan crippled me for many years and I'm not sure I would borrow the money if I had to do it again (my loan payment was $550 per month). Also, I borrowed $50,000 almost ten years ago for my entire education which I thought was (and is) a lot. I'm now hearing how some schools cost $40,000 a year and that doesn't even factor in living expenses! I don't know how a person just out of college can land a job to even come close to what that student loan payment would be.

I appreciate and agree with you that if your kids are going to be paying for school themselves that they will be more focused, treat their education and time with more respect and generally hustle a bit more than someone who doesn't understand the value of what they have, however I think that taking on that kind of debt (even if it sounds on the lower end of what other people are paying or borrowing) when you're young can be very tough to overcome especially if the market that you'll be getting a job in doesn't pay very much. I do think college education costs need to be a partnership between parents and kids. I really don't believe that a young adult should get a 100% free ride (even if the parents can afford to pay for it in cash) – unless he or she earned a scholarship.

This has been a very surprisingly interesting topic, that I thought I knew where I stood on, and I appreciate you being transparent on how your family handles/will handle this topic. Like you, I could talk about this topic for hours. Ha! I'm also curious if you'll talk about how you have and do handle paying for Bart's education. The reason I ask is because I know many families who waffle back and forth whether or not to take on that debt with a young family and also how you guys will pay it back and how you've had to modify your lifestyle to make it work. I'm also so curious to see how others handle these life situations.

Such an interesting topic! My husband and I have very strong feelings on this as well. My husband was given a full ride to a small private school – only his full ride covered the exact cost of tuition that first year and would not be adjusted for any price increases. 5 years later (4 of schooling, one co-op year he spent working), he graduated with $60k in debt – and it's been haunting him (and now me) since. I understand learning the value of money, but he wishes someone had helped him to figure out that the short term complications of transferring would still be less than the complications of living with student debt so many years after graduation. I received a full ride (that did adjust for inflation), but got very very sick my sophomore year and I pulled out to focus on my health. I should be able to go back in a few years, and for now, I'm figuring out what I want to study and do as a career. As for our kids, I'm not sure. At the very least, we are going to be open about our experiences, our knowledge of fiances, and encourage them to work hard for scholarships. We also know now the value of state schools- reputations can be very good and an affordable education is a rare commodity these days. All in all, it would be so nice to help them with undergrad if we can.

My parents paid for all three of us to go to the same state school, tuition and everything else. The deal was that if we graduated in less than four years, they would pay for a ticket for us to go to Europe. Because a ticket to Europe is a lot cheaper than a semester of college.

Obviously, I was incredibly lucky and unusual to be able to graduate with zero debt and a trip to Europe (I graduated in 3.5 years, mostly because I tested out of the language requirement thanks to my proficieny in high-school Spanish). My husband paid his way with scholarships and loans, and then more scholarships and loans for law school, so we're still paying those off.

We have three boys. They each have a savings account to which we contribute, but it's not really for college. Because, despite my own experience, we're not really planning on pushing college or paying for it as a matter of course. Even if we can, which I highly doubt. A trade would be just as desirable as a college degree, if not more so. You know how much our plumber makes? Enough to go on vacation every year to places like Japan. So if our kids get to 18 and don't know if they want to go to college, they can go to truck-driving school, or apprentice to an electrician, or just work on a farm driving machinery during haying season. And if they're really set on college, they will have to get scholarships or work for at least part of it. They'll figure it out. We'll help as we can, but it's their life, and we want them to know that college is not the only path to happiness.

I must be one of the lucky ones. I received a full tuition waiver based on my AIMS scores (AZ's old standardized test). I attended NAU on that tuition waiver, and then paid for my "room and board" with pell grants, school grants, and working part time on campus. I never lived on campus (not really a good situation at NAU), and I loved my time there. It was way cheaper to live off campus and a better environment. I graduated in 3.5 years, was married at the end of my sophomore year, and graduated debt-free. After I graduated, I worked full time for the university to get reduced tuition for my husband, had a baby, and still managed to get my husband graduated with only one tiny loan to repay. I'm a huge supporter of education–but the right kind. I do not believe in getting a degree that you can't use practically. We both have practical degrees that can get us jobs.

Part of me wants to laugh about this, and part of me wants to cry. Haha. I come from a family of 9 kids (typical Mormon family, right?!) and we always knew it was up to us to pay our way as soon as we hit 18. All of us got scholarships, worked part time, and ended up doing fine. I had enough scholarships that I was actually given a check at the end of semesters, but still worked part-time to pay living expenses. I had to work really hard, but it was still my favorite years by far! I came out of school with no debt and a bachelors degree that I loved. Fast forward to the middle of medical school with my husband. Because we had a great opportunity to go to a competitive school across the country we had to take out every loan we could. If you are familiar with med school families-those who go through school with kids–it is typical to come out of school with almost 500,000 in debt. This is from tuition, living expenses, costs of tests, interviews, flying to interviews, flying to take tests, the list goes on and on. It takes most doctors 10-15 years after residency to pay off their student loans. Which means we will pay ours off by the time we are fifty. This was really hard to digest coming from my background where debt free was always the goal. But I have been involved in groups online and in person where this really is the only way. So would I ever decide not to support my husband just because of debt? No way. The government is ridiculous in this respect, and I would generalize and say the average person has no idea what expenses a student has to go through to get through medical school, research, residency, and fellowship. Someday it will pay off. And we have NO IDEA what we are going to do with our kids' futures. I love that I had to pay for it all. It's exhilarating and liberating and so difficult to have to work for it yourself. But then my parents have stepped in to help (when cars break down, etc.) on a few bigs things now and then when they could. I think that's what I want for my kids. No ultimatums, just a recommendation that they have to do it all themselves, until they need a little help.

This was a topic I always avoided in college after learning the hard way my freshman year. Growing up we always knew that my parents would pay for our tuition, books & housing. We were on our own for all personal expenses (that integration actually started at age 8, but that's a story for another day). We had high school jobs and babysitting opportunities and a small monthly allowance (to teach us how to handle money) and a good education in how to save so by the time we graduated from high school we never asked our parents for personal things because we knew it was our responsibility to pay for them. That being said, when it came to college time and any of us five kids called my dad when tuition was due, we all felt humbled and grateful (and sometimes a little guilty, not my parents' intent ha) that they were helping us out with college. If we got poor grades the housing allowance was on the line and we'd have to move home (as much as we all loved home, we also loved our independence!). They allowed for a bit of time to figure out our majors and told us if it was getting out of hand we'd be responsible to pay (it took me 10 semesters – including my internship). After my Bachelor's I worked for a university hospital and they paid half tuition on my Master's and I managed to cover the second half without any debt. I will say though, 'degrees to nowhere' are a problem and I unfortunately fell into that. I studied what I found interesting (health promotion & education), but was disappointed in the lack of direction into the work field the college provided. I don't have kids yet, but I envision doing the same thing my parents did, likely because that's what I know and what worked for us. Great topic and so interesting to think about!

This topic is so fascinating to me. There was much discussion around the dinner table last night after I read this post. Josh always assumed the kids would be on their own. That's how it worked at his house and he's (rightfully) proud of the fact that he worked all the way through grad school. My parents helped where they could, but it wasn't anything like tuition. I was on my own for all of that as well, but they were very generous with providing my brother and me a car to share and filling in the summer I ended up abroad with negative dollars and all kinds of overdraft fees. Because my parents always gave what they could, I figured we'd do the same for our kids. What we'll be able to do is probably more than my parents could do for us. So we've sort of unofficially (clearly we have this all figured out!) planned on paying tuition and having the kids pay room/board. Your plan is similar, but it has a few significant differences. For example: what happens if the child gets a scholarship? I like the idea that the student gets the reward for that, since it's the student who has to earn/keep the scholarship.

All that said, my best friend's dad was a community college professor. Because tuition was free at the local community college, the deal in their house was this: live and home and attend the community college through your associate's and then mom and dad will pay for university. If you chose to go to university straight after high school, you're on your own the first two years. Now that Josh is a community college professor, that plan has factored its way into the discussion. We don't have a perfect plan yet, but I love hearing what everyone has to say!

Oh, and the degree discussion! (I posted this already and then spotted a typo. Bleh. Blogger needs an edit comment function.) Bart and I had the same major, I'm fairly certain, and I had some great professors that were extremely frank about what opportunities it would provide and what it would not. I never detected any difference in their discussions with me (one-on-one or in class) because I was a married woman. I was told, based on their professional experiences, what marketable skills and what overall enrichment the degree would give me (and what it would not). I think the question of what the plan is after school to actually generate income is a great one. That's not to say you can't get a Humanities degree, but getting specific work experience (tutoring writing continues to be pretty lucrative for me. Go Writing Fellows!) is huge. I feel the same way about the trade school discussion. I have a nephew that is an extremely talented welder with no desire to go to college. He has no problem making money. What he needs to plan on is what he'll do when he's too old to weld. He needs to learn about the up and downsides of owning his own business, for example, and how to get from welding for someone else to running his own shop. And now this comment is longer than the one I was editing, but seriously, this topic is so good.

Definitely a fascinating discussion. we are very lucky that tuition at BYU is really reasonably priced compared to other schools (I think if our kids go to a church school they won't be spending quite a quarter of a million dollars for school.But maybe they will with living costs). Matt attended BYU after his mission and did his freshman year at a community college. Soo he too missed out on the freshman experience. I wonder how that changes now the new missionary age. One of my roomates (she is super down to earth and not snobby) but her parents paid for her undergrad (100%) AND graduate school (and she went to medical school) AND paid for her husband's graduate school (LAW school) once they were married. Pretty insane that they had that much money to help up? And she had three other siblings so they were going to do the same for them and their spouses.

Good work ethic is very important to teach kids. I like that your dad capitalized "do not lose your scholarship"